Ever wondered what that mysterious number is that can make or break your financial dreams? Welcome to the world of FICO scores! This three-digit number is like your financial report card, telling lenders whether you’re a star student or if you need some extra credit tutoring. Whether you’re dreaming of buying a car, snagging that perfect apartment, or just want to flex with a shiny new credit card, your FICO score is the gatekeeper to all things credit. Let’s dive into what this score really means and why it’s got everyone from bankers to finfluencers talking.

| Key Point | Details |

|---|---|

| Definition | Credit score developed by Fair Isaac Corporation |

| Range | 300-850 |

| Usage | Used by lenders to assess creditworthiness |

| Importance | Affects loan approvals, interest rates, and credit terms |

| Components | Payment history, amounts owed, length of credit history, new credit, credit mix |

What is a FICO Score?

Alright, let’s break it down. A FICO score is basically your financial street cred, but instead of cool points, it’s all about how responsible you are with money. It’s a number between 300 and 850 that tells lenders how likely you are to pay back what you borrow. Think of it as a trust score – the higher it is, the more lenders trust you with their cash.

FICO stands for Fair Isaac Corporation, the company that cooked up this scoring system back in 1989. It’s like they created the ultimate financial video game, and your score is how well you’re playing.

Also read: Moolah

FICO Score Meaning: In the world of credit, your FICO score is your financial reputation boiled down to a single number. It’s what lenders look at to decide if they want to lend you money and how much interest they’re going to charge you.

FICO Score Meaning in Text: When you’re texting about finances (because who doesn’t love a good money chat?), you might see FICO pop up like this:

- “Just checked my FICO, it’s 750! 🎉 Time to apply for that loan!”

- “Ugh, my FICO took a hit. Guess I’m not getting that new car anytime soon 😭”

- “Working on my FICO game. Tryna get those numbers up! 💪💰”

It’s shorthand for saying “I’m either crushing it or getting crushed in the credit game.”

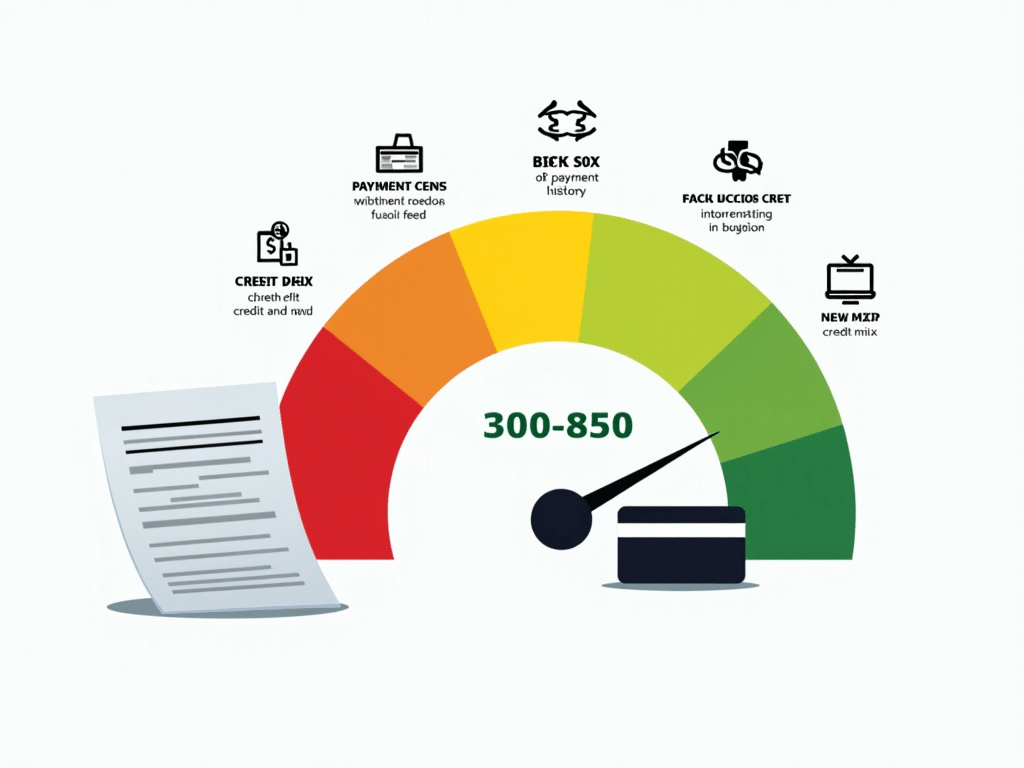

How FICO Scores are Calculated

Now, you might be thinking, “How do they come up with this magic number?” Well, it’s not magic – it’s math (sorry to disappoint). FICO looks at five main things:

- Payment History (35%): This is the biggie. Do you pay your bills on time? If yes, you’re golden. If not, well… let’s just say FICO isn’t impressed.

- Amounts Owed (30%): How much debt are you carrying? It’s not just about the amount, but how much of your available credit you’re using. Maxing out your cards is a big no-no.

- Length of Credit History (15%): The longer you’ve had credit, the better. It’s like leveling up in a game – the more experience you have, the higher your score.

- Credit Mix (10%): FICO likes to see that you can handle different types of credit. It’s like showing you’re not a one-trick pony.

- New Credit (10%): Opening a bunch of new accounts in a short time makes FICO nervous. It’s like saying “Whoa there, buddy, slow down!”

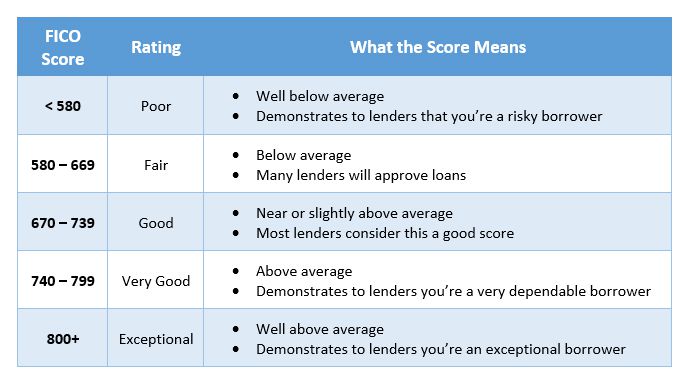

FICO Score Ranges and What They Mean

Your FICO score falls into one of these ranges:

| Score Range | Rating | What It Means |

|---|---|---|

| 300-579 | Poor | You’re in the financial doghouse. Lenders are gonna be side-eyeing you hard. |

| 580-669 | Fair | You’re not failing, but you’re not on the honor roll either. Some lenders might work with you, but expect higher interest rates. |

| 670-739 | Good | Now we’re talking! You’re in the “respectable” zone. Most lenders will be happy to work with you. |

| 740-799 | Very Good | You’re like the straight-A student of credit. Lenders are gonna love you. |

| 800-850 | Exceptional | You’re the valedictorian of credit. Lenders will be fighting over you, offering their best deals. |

Why FICO Scores Matter

You might be thinking, “Who cares about some number?” Well, turns out, a lot of people do. Your FICO score can affect:

- Whether you get approved for a loan or credit card

- The interest rate you’ll pay (higher score = lower interest = more money in your pocket)

- Your ability to rent an apartment (some landlords check credit scores)

- Even your job prospects (some employers check credit scores too)

It’s like your financial reputation following you around. A good FICO score can open doors, while a bad one… well, let’s just say it can make life a bit harder.

How to Check Your FICO Score

Now that you know why your FICO score is a big deal, you’re probably wondering, “How do I check this thing?” Good news – it’s easier than ever to peek at your score. Here are some ways:

- Credit Card Statements: Many credit cards now include your FICO score for free on your monthly statement. It’s like a bonus feature!

- Free Credit Score Websites: Sites like Credit Karma or Credit Sesame offer free credit scores. Just remember, these might be estimates and not your exact FICO score.

- Annual Credit Report: You can get a free credit report once a year from each of the three major credit bureaus. While this doesn’t include your FICO score, it shows the info used to calculate it.

- FICO’s Website: You can buy your score directly from FICO, but it’ll cost you some moolah.

Pro tip: Checking your own score doesn’t hurt it. It’s like looking in a mirror – you can do it as often as you want without messing up your reflection!

Improving Your FICO Score: The Glow-Up Guide

Alright, so maybe your FICO score isn’t quite where you want it to be. Don’t sweat it! Here’s how to give your score a glow-up:

- Pay Your Bills on Time: This is the golden rule. Set up auto-pay if you’re forgetful.

- Keep Your Credit Utilization Low: Try to use less than 30% of your available credit. It’s like eating – you don’t want to stuff yourself!

- Don’t Close Old Accounts: The longer your credit history, the better. It’s like fine wine – it gets better with age.

- Mix It Up: Having different types of credit (credit cards, loans) can help. But don’t go opening accounts just for the sake of it!

- Chill on the New Credit: Don’t apply for a bunch of new cards at once. It makes lenders nervous, like you’re about to go on a shopping spree.

Remember, improving your score is a marathon, not a sprint. It takes time, but stick with it and you’ll see results!

FICO Score Myths: Busting the BS

There’s a lot of misinformation out there about FICO scores. Let’s bust some myths:

- Myth: Checking your score lowers it.

Truth: Nope! Checking your own score is a “soft inquiry” and doesn’t affect it. - Myth: You only have one credit score.

Truth: You actually have multiple scores, and they can vary slightly. - Myth: Making more money improves your score.

Truth: Your income isn’t even part of your FICO score calculation! - Myth: Closing credit cards boosts your score.

Truth: It can actually hurt your score by reducing your available credit and shortening your credit history.

The Future of FICO Scores

The credit game is always changing, and FICO is no exception. Here’s what’s on the horizon:

- UltraFICO: This new score takes into account your banking habits, giving people with limited credit history a chance to shine.

- Alternative Data: FICO is looking at using things like utility payments and rental history to calculate scores.

- AI and Machine Learning: These tech buzzwords aren’t just for cryptobros anymore. They’re being used to make credit scoring more accurate.

The goal? To make credit scoring fairer and more inclusive. It’s like FICO is trying to level up its own game!

Wrapping It Up: Your FICO Score and You

So there you have it – the lowdown on FICO scores. It might seem like a lot, but remember:

- Your FICO score is important, but it doesn’t define you.

- You have the power to improve your score over time.

- Staying informed is half the battle.

Think of your FICO score as a financial fitness tracker. Just like you might count steps or track your workouts, keeping an eye on your FICO score helps you stay financially fit. And the best part? Unlike trying to get swole at the gym, improving your FICO score doesn’t require any heavy lifting – just some smart habits and a bit of patience.

So go forth, check that score, and start your journey to financial fitness. Who knows? With a little effort, you might just become the GOAT of credit scores. And remember, in the world of FICO, we’re all WAGMI (We’re All Gonna Make It)! 💪💰📈