ATM, short for Automated Teller Machine, has been a game-changer in the world of banking since its introduction. But did you know that ATM has a whole different meaning in the world of texting? Let’s dive into this dual-meaning acronym and explore its significance in both banking and modern communication.

| Key Takeaways |

|---|

| ATM in banking: Automated Teller Machine |

| ATM in texting: At The Moment |

| ATMs revolutionized 24/7 banking access |

| Texting ATM adds immediacy to conversations |

| Various ATM types: traditional, eco, and Bitcoin |

ATM: From Cash Machines to Texting Slang 💰📱

What Does “ATM” Mean?

ATM in Banking: Your 24/7 Money Buddy

In the world of finance, ATM stands for Automated Teller Machine. It’s that magical box that spits out cash when you need it most. 🏧 Remember that time you were at a concert and realized you forgot to bring cash? Yeah, the ATM saved your bacon that day!

ATMs have been around since the late 1960s, believe it or not. They’ve come a long way from just dispensing cash. Now, you can:

- Withdraw money (duh!)

- Deposit checks or cash

- Check your balance

- Transfer funds between accounts

- Pay bills

Fun fact: The first ATM was installed in London in 1967. Imagine the looks on people’s faces when they first saw money coming out of a machine!

Also read: SpankBsng

ATM in Texting: Keeping It Real-Time

Now, let’s switch gears to the world of texting. When you see “ATM” in a message, it usually means “At The Moment.” It’s a quick way to let someone know what you’re up to right now.

For example:

- “Can’t talk ATM, in class 🤫”

- “What are you doing ATM?”

- “I’m so bored ATM, wanna hang out?”

It’s all about that instant communication vibe. Just like how “NGL” means “Not Gonna Lie”, ATM adds a touch of immediacy to your conversations.

Types of ATMs: Not All Cash Machines Are Created Equal

Traditional Bank ATMs: The OG Money Dispensers

These are the ATMs we all know and love (or sometimes hate when they’re out of order). They’re usually affiliated with a specific bank and offer a range of services beyond just cash withdrawal.

Chase ATMs, for instance, are everywhere in the US. They’re like the Starbucks of the ATM world – you can find one on almost every corner in big cities. Chase customers can:

- Withdraw cash in various denominations (even $1 bills at some locations!)

- Deposit checks without envelopes

- Pay credit card bills

- Transfer money between accounts

Eco ATMs: Turning Old Phones into Cold Hard Cash

Ever wondered what to do with that drawer full of old phones? Enter the eco ATM! These nifty machines let you recycle your old electronics for cash on the spot. Here’s how they work:

- Bring your old device to an eco ATM

- The machine scans your device and assesses its value

- You get an offer on the spot

- If you accept, ka-ching! 💵 Cash in your hand

It’s like a reverse ATM – you put in a phone, and it gives you money. Plus, you’re doing something good for the environment. Win-win!

Also read: Flex Meaning

Bitcoin ATMs: Crypto Goes Physical

Bitcoin ATMs are the new kids on the block. They’re like traditional ATMs, but for cryptocurrency. You can use them to:

- Buy Bitcoin with cash

- Sell Bitcoin for cash

- Sometimes buy other cryptocurrencies

Using a Bitcoin ATM feels a bit like being in a sci-fi movie. You’re dealing with digital currency, but in a physical way. It’s pretty wild when you think about it!

Also read: WEEB

How ATMs Work: The Magic Behind the Machine

Ever wondered what happens when you stick your card into an ATM? Let’s break it down:

- Card Reader: Reads your card info

- Keypad: Where you enter your PIN (don’t let anyone peek!)

- Computer: Processes your request

- Cash Dispenser: The part we all love – where the money comes out

- Receipt Printer: Gives you a record of your transaction

When you make a transaction, the ATM connects to your bank’s network to verify your account and process your request. It’s like a super-fast, secure messenger between you and your bank.

ATM Security: Keeping Your Money Safe

ATMs might seem vulnerable, sitting out there all alone, but they’re tougher than they look. They’ve got some serious security features:

- PIN Protection: Your secret code to access your account

- Encryption: Scrambles your data so hackers can’t read it

- Anti-Skimming Devices: Prevents thieves from copying your card info

- Surveillance Cameras: Keeps an eye out for any suspicious activity

Pro tip: Always cover the keypad when entering your PIN. You never know who might be watching!

Also read: OOMF Meaning

ATM Locations: Finding Cash When You Need It

ATMs are everywhere these days. You can find them:

- Inside banks (obviously)

- At convenience stores

- In shopping malls

- At gas stations

- Even at some music festivals!

But here’s a cool trick: most banking apps now have ATM locators. So next time you’re in a pinch, just whip out your phone and find the nearest cash machine. It’s like Pokémon GO, but for money! 😄

Cash Management in ATMs: Keeping the Money Flowing

Ever wondered how ATMs never seem to run out of cash? It’s not magic, it’s smart cash management. Banks use fancy algorithms to predict when and where people will need cash. It’s like they’re psychic, but with spreadsheets.

Here’s how they keep the cash flowing:

- Predictive Analysis: Using data to guess when an ATM will need a refill

- Just-in-Time Replenishment: Filling up ATMs right before they run low

- Route Optimization: Planning the most efficient routes for cash deliveries

Next time you withdraw cash, think about all the planning that went into making sure that money was there for you. It’s pretty impressive, right?

Also read: NEPO BABY

ATM Fees: The Price of Convenience

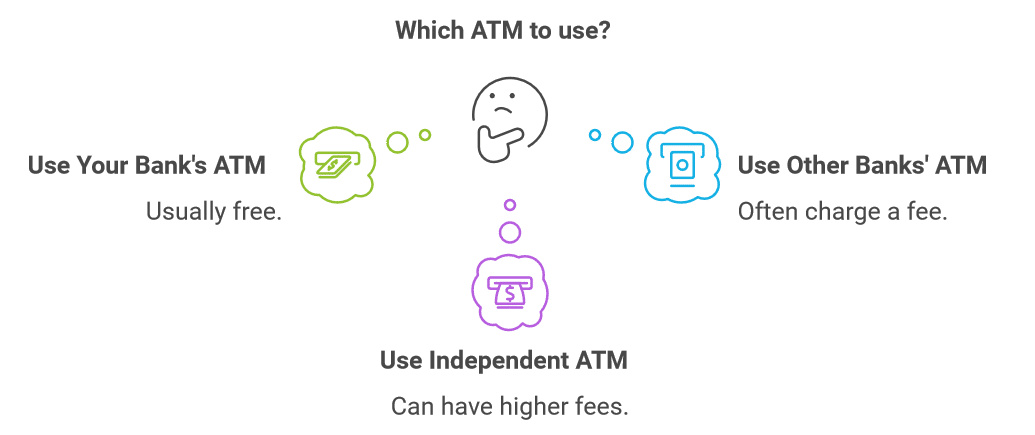

Ah, ATM fees. The bane of our existence when we’re desperate for cash. Here’s the lowdown:

- Your Bank’s ATMs: Usually free (yay!)

- Other Banks’ ATMs: Often charge a fee (boo!)

- Independent ATMs: Can have higher fees (double boo!)

Pro tip: Some banks refund ATM fees, even from other banks’ machines. It’s worth checking if yours does – it could save you a bunch!

The Future of ATMs: More Than Just Cash Machines

ATMs are getting smarter. Soon, they might be able to:

- Scan your face instead of using a card

- Offer video chats with bank tellers

- Dispense other items like stamps or gift cards

Imagine walking up to an ATM and having it greet you by name. Creepy or cool? You decide!

Pros and Cons of ATMs: The Good, The Bad, and The Techy

Let’s break it down:

Pros:

- 24/7 access to your money

- Convenient locations

- Multiple services beyond just cash withdrawal

Cons:

- Fees can add up

- Security concerns (though they’re getting safer all the time)

- Can break down or run out of cash

ATM in Texting: Keeping Conversations Flowing

Remember, in the texting world, ATM means “At The Moment.” It’s super useful for quick updates:

- “What are you doing ATM?”

- “ATM, I’m binge-watching that new series you recommended!”

It’s like the slang term “GOAT” – once you start using it, you’ll wonder how you ever lived without it!

Wrapping It Up: ATMs in Our Lives

Whether you’re withdrawing cash or letting your friend know what you’re up to ATM, this little acronym plays a big role in our daily lives. From revolutionizing banking to spicing up our text convos, ATM has come a long way.

So next time you’re standing in front of an ATM, think about its journey. And when you’re texting your friends about what you’re doing ATM, appreciate how language evolves. Who knows? Maybe in a few years, we’ll have a whole new meaning for ATM. Language is cool like that. 😎

Remember, whether it’s banking or texting, ATM is all about the here and now. So live in the moment, manage your money wisely, and keep those text convos flowing! 💬💰